Is This Why Central Banks are Rushing to Buy Gold?

The comments below are an edited and abridged synopsis of an article by Brandon Smith

Everyone has a different theory on why gold is rising. Some say it is because of Fed stimulus, but the most recent upward gold trend started when the Fed was tightening liquidity and raising rates, not stimulating. Also, many analysts suggest that precious metals absorb investment cash flows when equities are sliding, but stocks have been rallying for the past year as gold prices also trend upward. So, what is going on here?

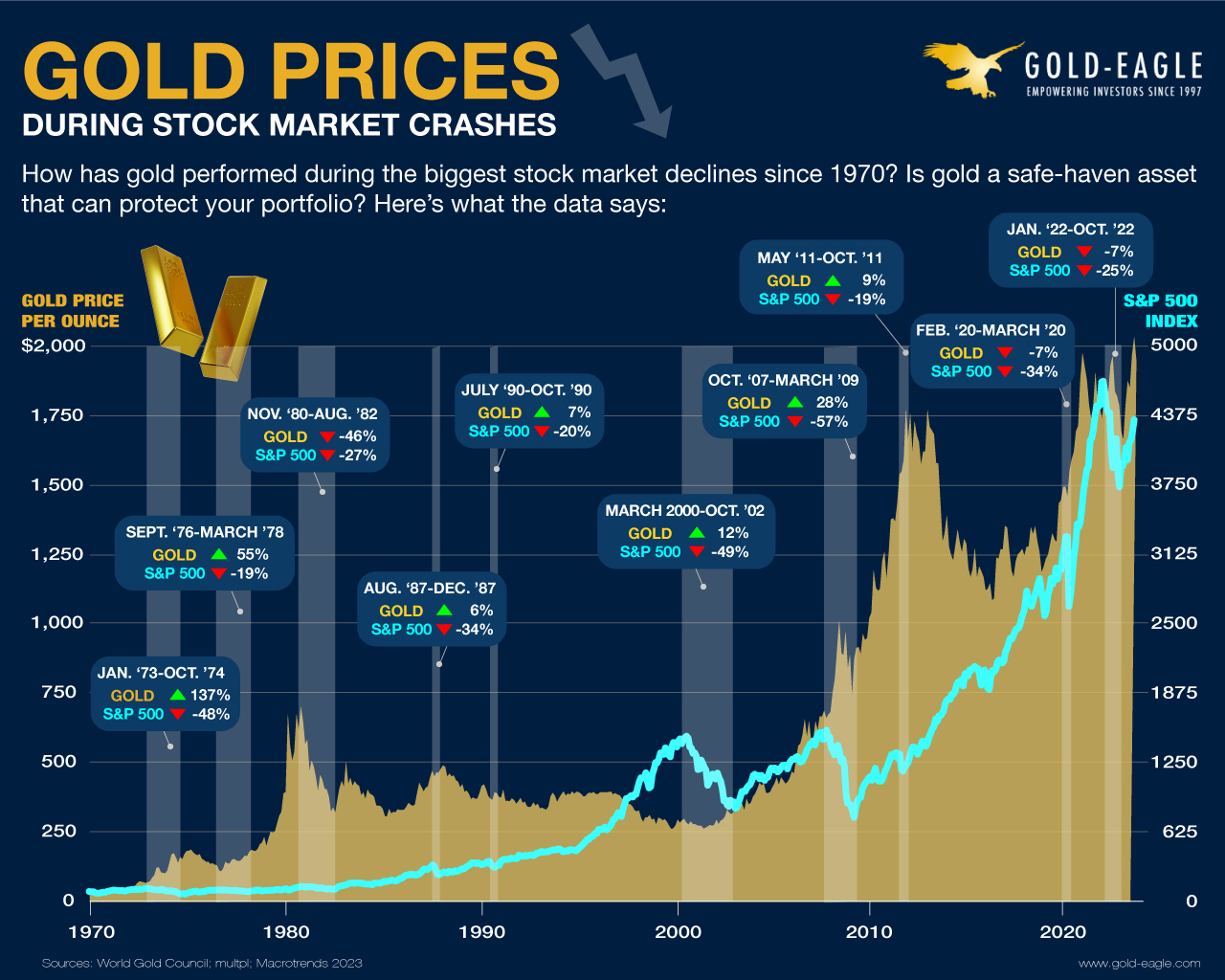

Gold is not just an inflation hedge, but also a crisis hedge. As economic and geopolitical uncertainty grows, gold rises. While there has been uncertainty and instability for a decade, Americans believe there are checks and balances to counter any potential disaster in the financial structure. They assume that the government or the banks will step in, but there are signs that may not be the case.

The bottom line is, there is a gold rush going on by central banks as well as governments, and the public is being left out of the loop as to why.

Banks and governments know that a global crisis is imminent, and so they prepare by buying the one commodity that always goes up when trouble strikes and assets fall.

Economic disasters do not generally happen in a vacuum. Geopolitical threats trigger the collapse of financial bubbles, or they are engineered to coincide with the bubble collapse in order to obscure the culprits behind it. Somehow, it would appear that central banks are privy to a looming calamity that will result in a threat to the current monetary order.

The rift between the US and its trading partners, along with the increased danger of war with nations like Iran, are setting the stage for the loss of the dollar’s world reserve status. Such a reset would leave the US economy shattered for decades to come, as it gets used to losing the thread that was holding the system together. Rebuilding the system without reserve status can only happen if central bankers are removed from the equation and true free markets and price discovery are allowed to flourish.

While price fluctuations are always rampant in times like this, the overall trend for precious metals will be up from now on. And, unless you suddenly see central banks start dumping their gold reserves instead of buying hand over fist, Smith suggests that readers copy their strategy and get a stack of physical gold, too.