Gold Prices During Stock Market Crashes | Chart of the Week

Gold has traditionally been considered the ultimate “safe-haven asset,” offering protection to investors in times of stock market turmoil.

However, does gold’s reputation as a safe haven remain intact? Can it genuinely shield your investment portfolio from the chaos of a declining stock market? To uncover the truth, Gold-Eagle delved into the data.

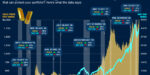

The infographic below illustrates the ten most significant declines in the S&P 500 index since 1970 and juxtaposes them with the fluctuations in gold prices over the same period.

Sources: Gold-Eagle

Regrettably, stock market crashes are unavoidable, and many contemporary market analysts are forecasting potentially severe, even historically significant, market downturns in the foreseeable future.

The question arises: Is diversifying your investment portfolio with gold, as advocated by some, a prudent strategy to fortify your holdings against the economic turmoil that accompanies a stock market crash?

A careful examination of the data leaves little room for doubt. Gold has exhibited substantial value appreciation during most of the market crashes since 1970. In fact, during the most severe market plunge in the past half-century, spanning from October 2007 to March 2009, gold saw an impressive 28 percent surge, while the S&P 500 plummeted by a staggering 57 percent! This striking example alone underscores the potential effectiveness of gold as a safeguard against substantial market declines.

The zenith of gold’s performance coincided with the two major S&P 500 market downturns of the 1970s, with remarkable price surges of 137 percent and 55 percent.

There were three instances where gold prices experienced declines concurrently with the S&P 500. Yet, even in these situations, gold notably outperformed the S&P 500 in two out of the three stock market crashes.

The exception was the bear market spanning from 1980 to 1982, during which gold witnessed a 46% decline, compared to the S&P 500’s 27% drop. Notably, this anomaly occurred shortly after the largest gold bull market in modern history, during which the precious metal surged by an astonishing 2,300% from its 1970 low.

However, when we examine the averages across the ten market declines, it further underscores gold’s status as a safe-haven asset capable of safeguarding your investment portfolio from the dangers of a plummeting stock market. On average, the S&P 500 declined by 33%, while gold increased by an average of 19%.

Incorporating gold into your investment portfolio can be a prudent choice, particularly when you have concerns about the condition of the financial markets and the overall economy.