No Matter How You Turn It, The Global System Is Already Doomed: Got Gold?

The comments below are an edited and abridged synopsis of an article by Matthew Piepenburg

Piepenberg looks at the interplay of embarrassing debt, dying currencies and failed monetary fantasies masquerading as policies to confirm that, no matter how one turns or spins the inflation/deflation, QT/QE or recession/no-recession narratives, the global financial system is already doomed.

Up for discussion: Recession—the elephant in the room; still hoping for a softish landing; the simple math of liquidity; is it a race to the bottom for risk assets; more easing won’t bring ease; the damage already wrought by the strong US dollar; strong dollar or weak, no one wins; Yellen, squawking for a weaker dollar; weaker dollar ahead; Powell—ignoring reality and Yellen; we are doomed either way; supercore (CPI) lies from on high; a historical turning point; and gold—a far more loyal lieutenant.

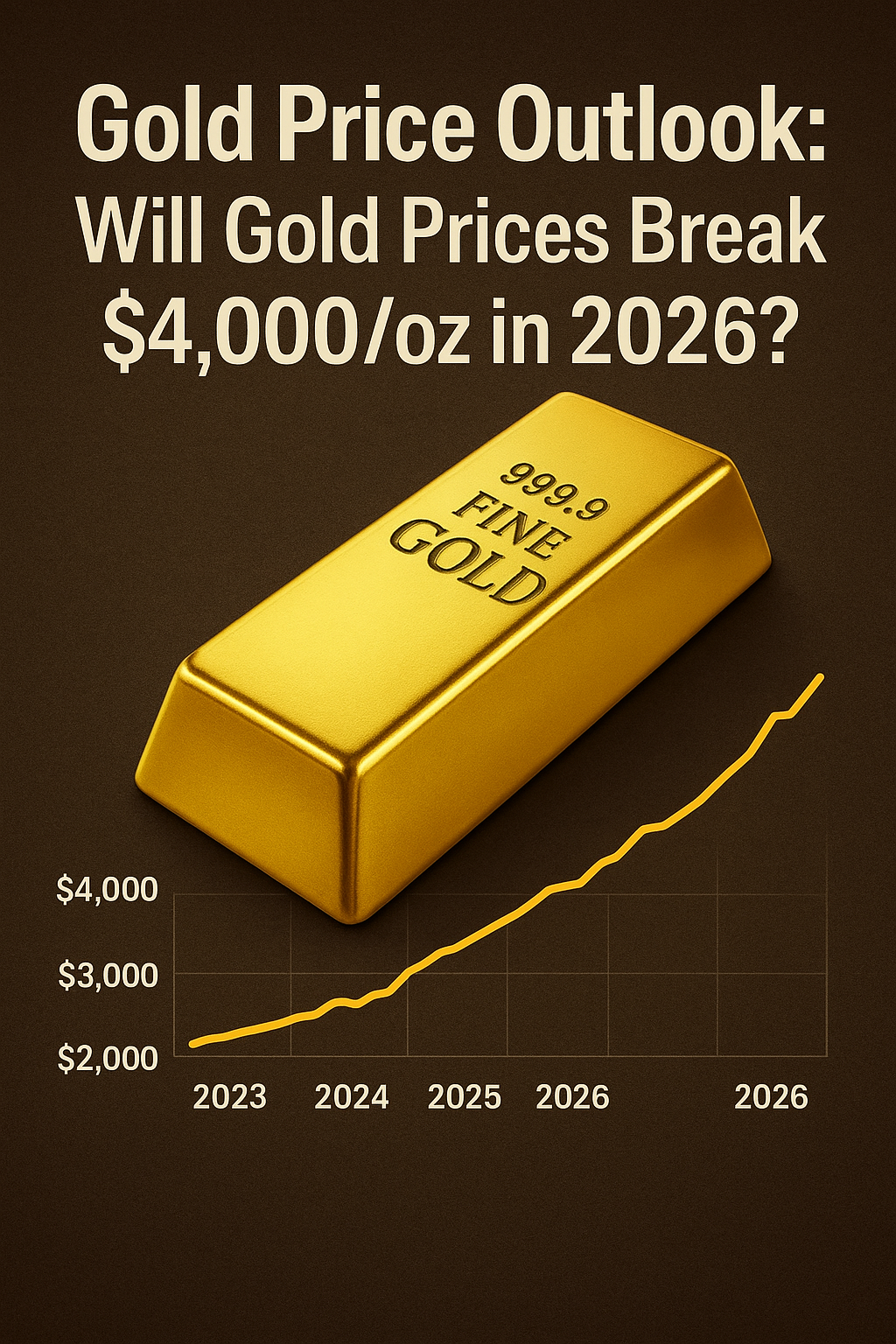

Gold was a much more loyal asset than stocks and bonds in the turbulent times of 2022, and given that 2023 portends to be even worse, we can expect more of the same from the yellow metal.

With inflation ripping and war blazing, many argue that gold did not do enough, but gold in every currency apart from the dollar would beg to differ.

Gold’s future strength and rise is easy to foresee, as gold doesn’t rise, currencies just fall. It’s really that simple.

Got gold?