Mint Shortages Further Pressure Supply amid High Demand

The comments below are an edited and abridged synopsis of an article by Clint Siegner

In August, demand for bullion slacked a bit from the frenetic pace set over the past two years. But buyers came back with a vengeance during September, and inventories of the most popular products are showing the strain.

Premiums are back on the rise and delivery delays have returned for many items, with silver inventories being hardest hit.

As buyers turn away from higher-priced silver coins, 1-ounce silver rounds and bars of various sizes are now experiencing supply issues.

The major constraint is in the capacity of mints and refiners to produce retail bullion products. While demand for 1,000-oz silver bars appears strong, premiums for those large bars are holding steady.

If 1,000-oz bar premiums rise, will be signaling a true shortage of silver. For now, the shortage is in the fabrication capacity of mints and refiners who convert large bars into smaller products.

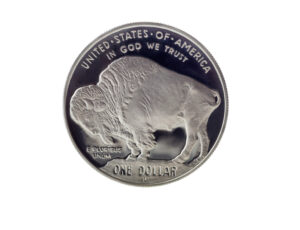

The pressure on premiums has been driven, at least in part, by the U.S. Mint. Despite its obligation to produce coins in quantities sufficient to meet public demand, the Mint has done nothing to increase supply.

Demand spiked for bullion products 2.5 years ago. Private mints and refiners have been steadily growing capacity, but the U.S. Mint is manufacturing excuses instead.

Mint Director Ventris Gibson blames both Covid and on the vendors who supply blanks. She hopes to add new vendors rather than gearing up to produce blanks in-house.

Gibson did not discuss plans to increase inventories during periods when demand is slower. If the Mint has plans to add any people, equipment or in-house capacity, Gibson didn’t mention that either.