Could we Be Heading Back towards a Gold Standard?

The comments below are an edited and abridged synopsis of an article by Lawrence Thomas

For those following gold, a significant development in the finance industry is the emergence of Judy Shelton within the Federal Reserve.

President Trump recently nominated Shelton and Christopher Waller to fill two vacancies on the Fed’s Board of Governors. Shelton has advocated for lower rates and also the reintroduction of a gold standard. The president has criticized Fed Chairman Jerome Powell for not lowering interest rates quickly enough.

This is an interesting development because, if Trump is reelected, he could appoint Shelton as the next Fed chairman (Powell’s term ends in February 2022).

With the insanity of negative interest rates coming to the fore across many economies, the reintroduction of gold into monetary policy does not seem unreasonable. The objective of money is to be a medium of exchange and unit of account, but also a store of value. Gold has been doing this for thousands of years.

In addition, Trump understands the gold market and its importance as a stabilizer in turbulent economic times. He has tweeted about gold on several occasions.

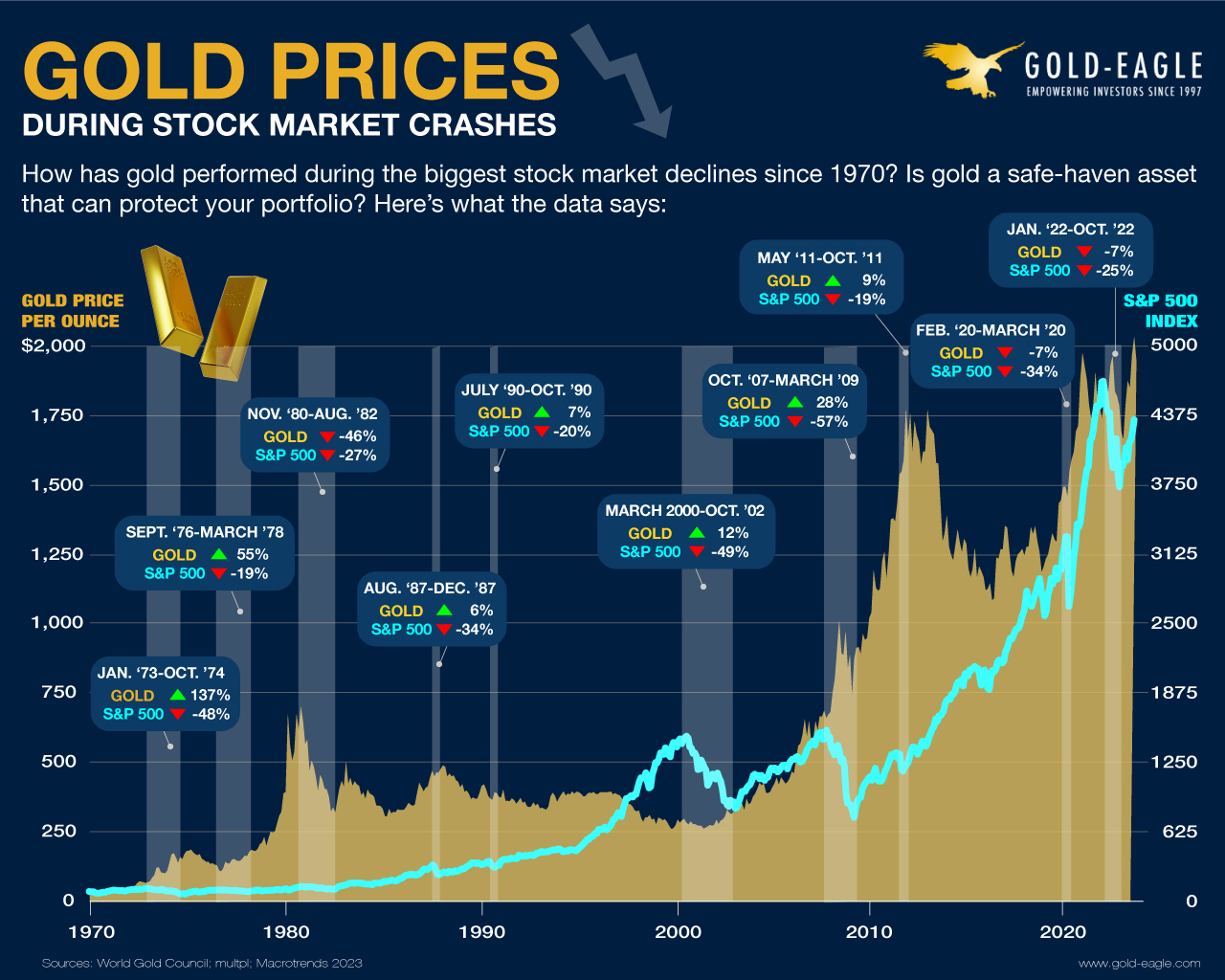

Economically, maybe Trump assumes normalized interest rates are not coming back due to the endless money printing that took place after 2008. The world of negative-yielding debt is beginning to be a reality, which will continually debase currencies globally. One of the only things to hedge this debasement is, of course, gold.

There continues to be record central bank gold buying, negative interest rates around the world, unprecedented public and private debt, and deep trade disputes (the US and China’s phase one deal is not a resolution to the trade war) to go alongside geopolitical tensions, which clearly signifies that the world is in uncharted waters.

Look for governments to slowly return to the oldest form of money—gold.