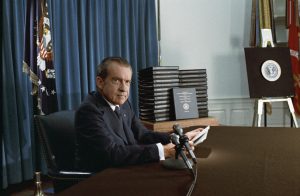

The Untold Story of Nixon and The $35 Gold Peg

The comments below are an edited and abridged synopsis of an article by Mark J. Lundeen

The current mismatch between price and risk in the bond market is a perfect setup for gold and silver to go to levels few people would believe possible. Before the coming bull market in gold and silver concludes, we’ll see gold trading far above $30,000 and silver well above $3,000. How is that possible? The US dollar is the plaything of Washington and Wall Street. Before they are through with it, they will render it worthless. Then, no one will exchange an ounce of gold or silver for any amount of dollars.

How is gold doing in the global market place? Since January 2001, not bad. Considering the thousands of tons of paper gold sold in the futures market at the COMEX (promises to deliver tons of metal that are never kept) their performances are good.

Gold looks good in its bear’s eye view (BEV) chart line, too. It has cleared a rising trend line and is about to break above its BEV -30% line. Of interest is gold’s BEV -27.5% line ($1,360); since August 2013, this line has become the line-of-death for the gold market. Six years of seeing any advance in the price of gold stopped dead on any attempt to rise above it.

What we’d like to see is gold breaking above its BEV chart -27.5% line, and then take out its BEV -25% line ($1,416) soon after.

Gold’s step sum chart is excellent. It has broken above a line of resistance. Since January 1, the gold price has advanced about $50 as the step sum has done nothing, trending sideways for the past six weeks. That’s constructive market action for the bulls, seeing gold climbing a wall of worry.

At present, gold and silver markets have low volatility. While a positive for the stock market, it’s a negative for precious metals markets. We’ll know when the monetary metals are on the move, because daily volatility in the metals will demand everyone’s attention.

With gold and silver, an increase in volatility also occurs on market declines. However, gold is coming off a correction (December 2015), and Lundeen expects the next big move will be to the upside. We’ll be able to identify precisely when it begins, when after a pause of over two years we see daily moves of +/- 3%.

This is the lowest volatility since the 2001 start of the current bull market, which is why precious metals have so few followers. This isn’t necessarily a bad thing – if you’re buying and have the self-discipline to hold your position until the market turns.

It’s not hard predicting what comes next: the 2020s will be the decade when gold, silver and commodities see a monster bull market as everything financial begins to deflate.

Many people will suffer from the coming deflationary bear market in financial assets. Take steps to protect yourself by acquiring some gold and silver. Just buy it, and forget about it. Someday you’ll be glad you did.