The U.S. Presidential Election, The Economy, and Gold: How to Prepare for The Coming Market Crash

This article was written for Taxes and Wealth Management Issue13-3, a newsletter published by Taxnet Pro.

Global stock markets suffered the worst first quarter in their history in 2020, as the COVID-19 pandemic rattled markets. After slowing 5% in the first three months of 2020, the U.S. economy shrank by a whopping 33% in the second quarter. If you think these numbers are bad, it is only going to get worse. The second wave of the pandemic is forcing governments around the world to renew lockdown measures that will push the U.S. economy, and most western economies, to the brink.

Chaotic elections, a battered economy

This is all happening at a time when the U.S. is about to face the most chaotic presidential election in its history in November. Rioting and civil insurrection are occurring in U.S. cities, and crime is accelerating. Lawsuits over mail-in ballots have already started across the country. What’s more, the nomination of Amy Coney Barrett as successor to Ruth Bader Ginsburg promises to be hotly contested, as the choice of nominee will have huge implications following the election. If the election result is disputed, the U.S. Supreme Court may end up deciding whether Trump or Biden will be president for the next four years.

If the global pandemic, civil unrest in many U.S. cities, war looming in Armenia, thus pulling Russia, NATO and the European Union into a conflict were not enough, the U.S. economy, as well as most western economies — including Canada’s – are going to get a whole lot worse.

Overvalued markets, declining corporate profits

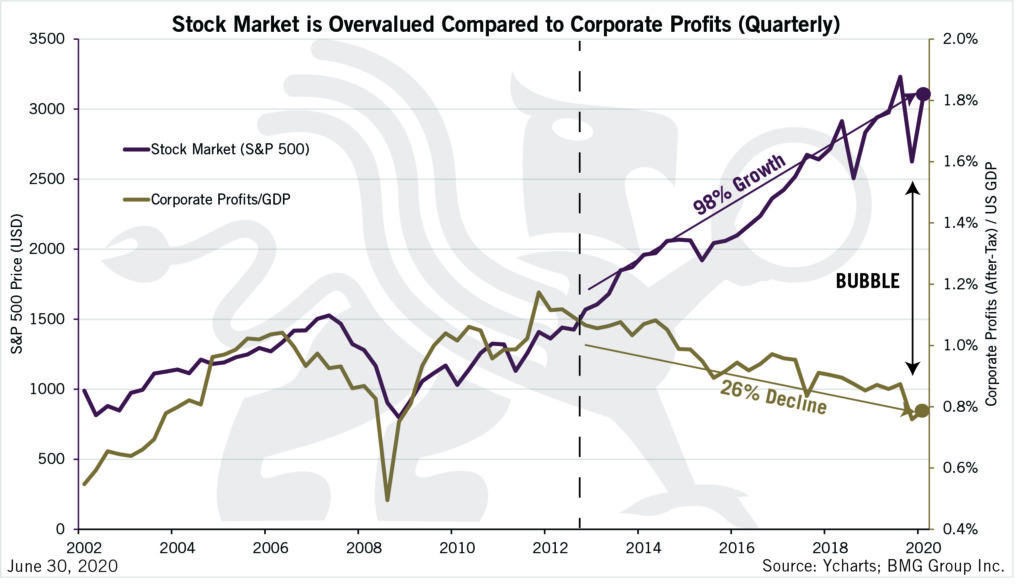

U.S. equity markets and corporate profits were already on a divergent path well before COVID-19 hit, and this trend will only continue – especially if the second wave forces more closures and lockdowns in the fall and winter. Restaurants, hotels, travel and tourism, airlines, and small businesses across the country are barely hanging on. Bankruptcies are set to skyrocket.

Coming defaults in the real estate sector

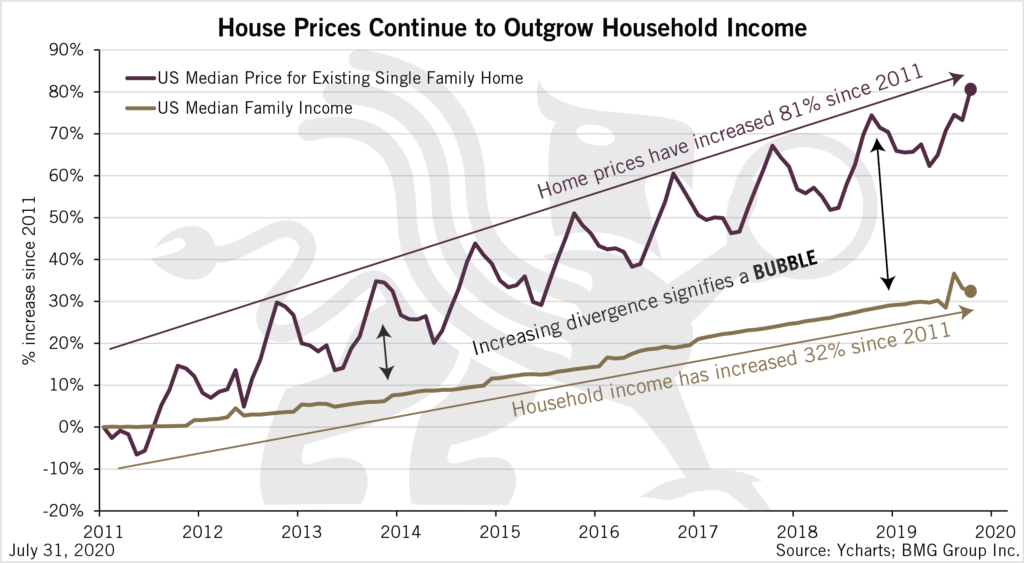

One of the biggest economic issues — one that hasn’t received a lot of attention — is the wave of defaults that will hit all areas of the real estate sector. Financial districts of major cities are ghost towns. It’s just a matter of time before large tenants terminate or default on their leases. Developers are stuck in a rut, as demand has collapsed.

Mortgage defaults and collapsing real estate markets will in turn lead to problems in the banking sector. In fact, mortgage delinquency rates in the U.S. climbed to 8.2% at the end of June – the highest level since 2011. More than 8% of all U.S. mortgages were past due or in foreclosure.

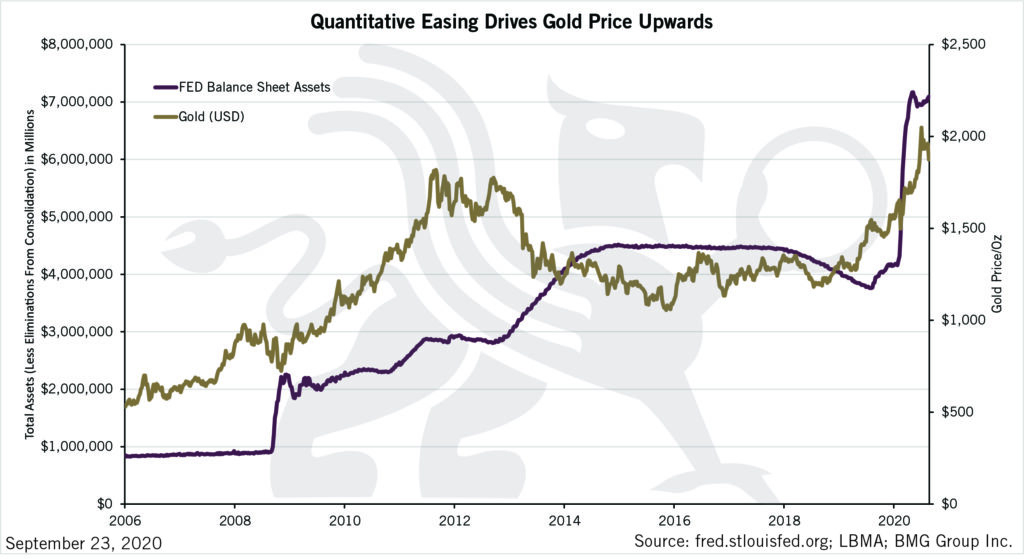

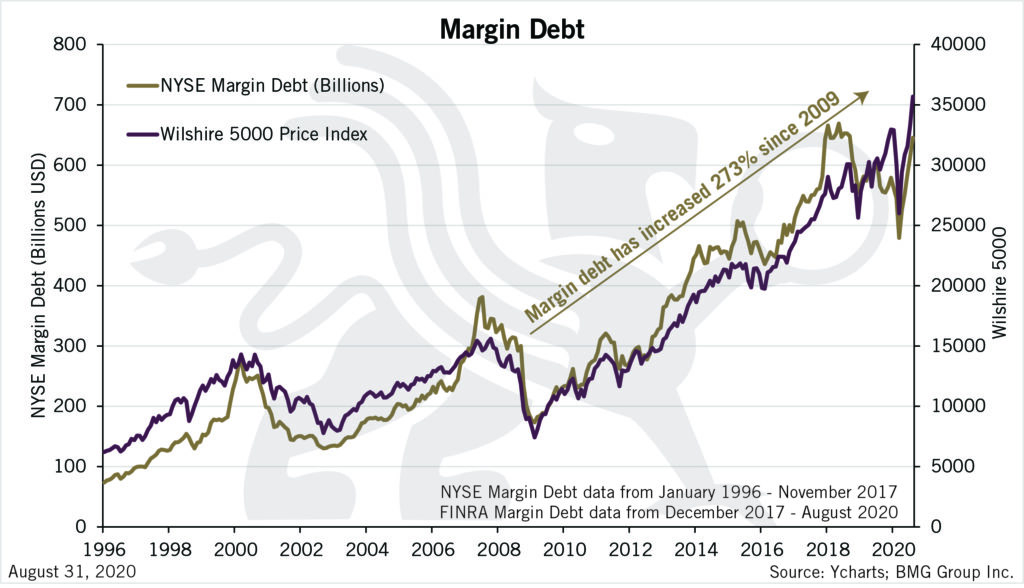

To keep the economy from collapsing, the U.S. Federal Reserve and other western central banks are going to have to print even more money, which will only exacerbate the bubbles in the financial markets and margin debt levels. What’s most worrisome is that all these factors — declining markets, a shrinking economy, and the second wave of the pandemic — are morphing together just as the U.S. is about to face one of the most chaotic presidential elections in history.

How should investors proceed?

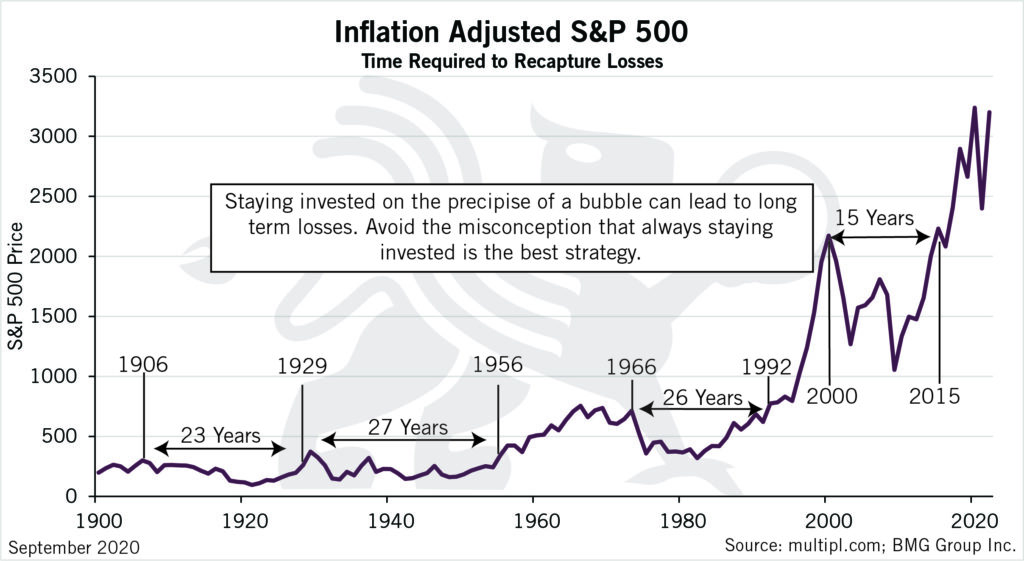

What are investors to do? If you listen to the media or those in the industry, the mantra is to stay invested for the long term. That strategy works well during long bull markets. However, this strategy doesn’t make sense when you’re standing on the edge of a precipice — which we are today.

The market is poised to fall much further, so it does not make sense to stay invested in financial assets and suffer additional losses. In fact, if a portfolio declines by 50%, it would have to increase by 100% just to break even. Market history is full of examples of this.

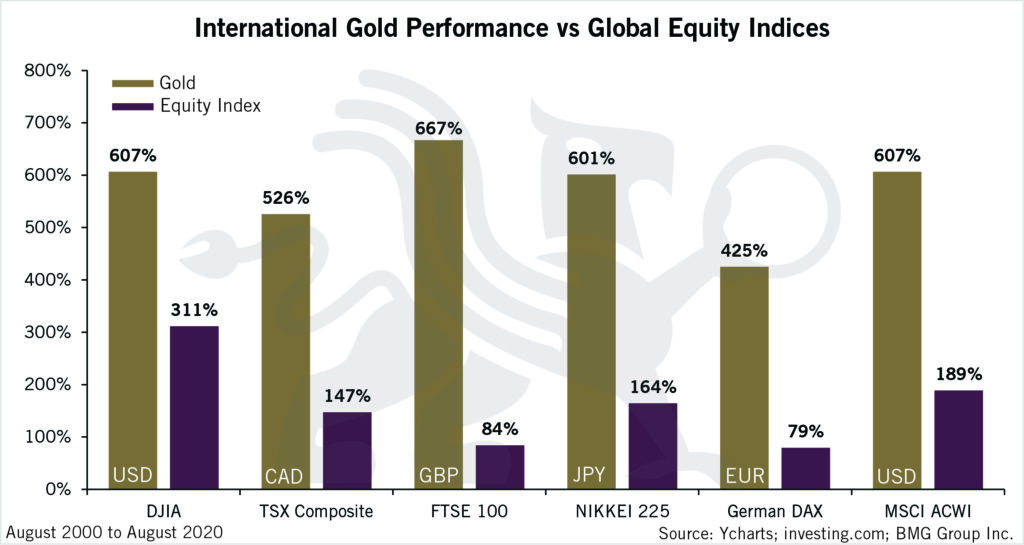

For self-directed investors using discount brokerage accounts, a better strategy would be switching to Class D units of BMG Mutual Funds. The best place to be invested while awaiting the market crash is gold bullion, because gold has a low correlation to other asset classes and has historically appreciated during broad market corrections. In fact, gold has risen dramatically this year, and will continue to do so while other asset classes continue to decline.

An investment strategy for today’s markets

For accredited investors and institutions, an even better strategy would be switching to gold, experiencing significant gains, and then redeploying those gains to a diversified portfolio of stocks, bonds, REITs, gold and silver when the market has finished correcting. This is exactly what the BMG Diversified Hedge Fund is designed to do.

A properly structured and timed transition into the best-performing funds across four asset classes – equities, fixed income, real estate, and gold and silver bullion – will significantly improve yields and capital appreciation while maintaining low levels of volatility, when there is a broad and sustained market recovery.

At BMG, we back-tested this strategy with our BMG Diversified Hedge Fund and found that implementing it during the 2008 financial crisis would have resulted in annual gains of 22% for 12 years afterwards. Plus, investors would have received over $45,000 in dividends over this period on an initial $25,000 investment.

Now is not the time to stay invested. Many baby boomers will simply not live long enough to break even. Instead of moving to cash, consider that gold can provide your portfolio investment gains, true diversification away from stock and bond markets, and a hedge against the coming market crash. The chaos in the economy and the U.S. presidential election means the price of gold will continue to increase dramatically in the foreseeable future.

The information contained in this article provides a general overview of subjects covered, and the expressed personal views and opinions are not intended to be taken as advice regarding any product, organization or individual, and should not be relied upon as such. Consult your investment and legal advisors regarding specific coverage issues. Information and opinions expressed in this article are provided without warranty of any kind, either express or implied, including, without limitation, warranties of merchantability, fitness for a particular purpose, and non-infringement. BMG uses reasonable efforts to include accurate and up-to-date information from public domains and sources but does not make any warranties or representations as to its accuracy or completeness. BMG assumes no liability or responsibility for any errors or omissions in the content of this article.

Since the BMG Group is in Canada, how doe one get to make an investment from the United States?? Please advise.

Hello Leon,

Please contact us at 1.888.474.1001 ext. 2957 and we will be happy to go over investment options with you.

Thank you!