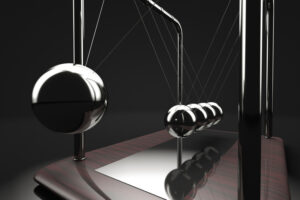

Two Very Big Narratives on A Collision Course

The comments below are an edited and abridged synopsis of an article by Peter Tchir

“I generally hate FOMC meeting days. Despite all the preparation you’ve done, most of us seem to spend the hours ahead of the decision at 2pm and the press conference at 2:30 second guessing everything. Staring at the tape trying to divine some information that you’ve missed. That isn’t made any easier in what has been an extremely volatile tape with intraday swings that are as violent and large as I’ve seen in a long time.”

“We will come back to the Fed in a moment, but there is a consensus, which I generally agree with, that Fed days tend to support risk assets. That whatever fears we have built up will be assuaged when Chair Powell finally addresses us.”

Up for discussion: Microsoft; capitulation or all-in; the Fed—today; the Fed—over time; and two very big narratives on a collision course.

“With all that said: Mildly bearish to neutral on risk coming into the Fed since need to respect the propensity to pop (more bearish if we rally more ahead of the Fed).”

“QT or lack thereof will be my key trigger… No QT or much delayed QT and the valuation thesis can be put off for another day… With QT I think the selling pressure in those areas returns.”