A Surging National Debt Is Bullish for Gold

The comments below are an edited and abridged synopsis of an article by Michael Maharrey

America’s debt ceiling drama ended with fake budget cuts and a credit card with no limit for the government. Americans can expect a surge in the national debt as the US government plays catch up after nearly six months up against its borrowing limit.

How might this affect the gold price? If history is any indication, it will likely drive it higher.

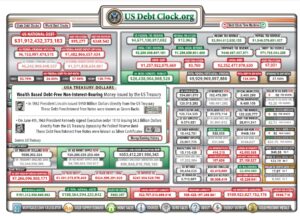

The first business day after the deal went into effect, the US Treasury increased the national debt by over $350 billion. By June 8, it had increased by just over $454 billion to $31.9 trillion.

More increases lie ahead. In fact, it will be no surprise if the national debt eclipses $32 trillion this week. Not only does the Treasury have to borrow to replenish its checking account, but it will also have to borrow to cover the budget deficits the Biden administration runs.

Spending is set to go up during the next two years. The US government is blowing through nearly half a trillion dollars monthly and the deficit for fiscal 2023 was already close to $1 trillion with five months to go. The spending, and its accompanying deficit, won’t end in the foreseeable future.

Typically, big spikes in the national debt correspond with a rising gold price. Gold has generally trended upward along with the national debt. There are other factors that affect gold, but the general trend is worth noting. This correlation makes sense for a couple of reasons.

First, a rising national debt creates economic uncertainty that drives safe haven buying. Most people recognize that the national debt trajectory is unsustainable. The longer the debt climbs and politicians kick the can down the road, the shorter the road gets.

Second, more national debt ultimately means more inflation. At some point, this unlimited borrowing will force the Fed to monetize some of the debt. That will require a return to quantitative easing. There is no other way for the market to absorb all the debt the Treasury will have to issue to support spending that will mostly go on a credit card with no limits.

To prop up the bond market and keep prices high and interest rates low, the Fed will ultimately have to buy bonds to boost demand. It will buy those bonds with money created out of thin air.

With this in mind, it makes sense that people would turn to gold as an inflation hedge.