The Silver Chart THEY Do Not Want You to See

The comments below are an edited and abridged synopsis of an article by Keith Weiner

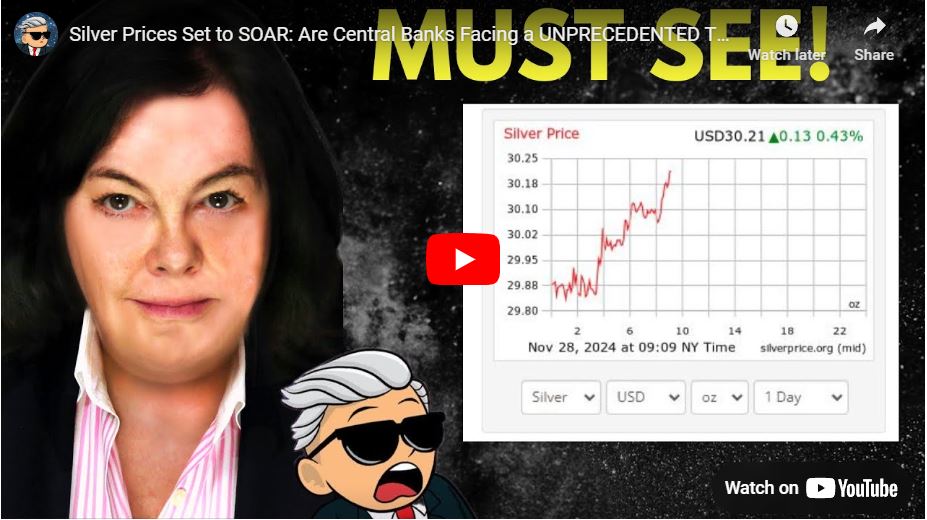

On May 12, the silver price fell about a dollar. As with all of these big price moves, the question is: What really happened? Included is a chart of the day’s action, with the price overlaid with basis (basis = future – spot). It is the only indicator of abundance or scarcity of metal to the market. However, here it is used for a different, simpler purpose. We want to see the relative moves in the spot price and the near futures contract price (i.e. July).

The day was mixed. Before noon, the basis was volatile but tended to fall with the falling price. The basis drops from around -1.1% to -1.5%. But after noon, something changed.

There was a falling price and rising basis. The basis tends to follow the shape of the price line, but wends its way up as the price continues to fall. The day ends with the basis at or above the level where it began, but the price is far below.

The basic theory behind precious metals’ market complexity is that the banks sell futures to manipulate the price. In other words, they do so without means or intent to deliver the metal. There’s a lot to say about this, but for now Weiner focuses on one thing: The price of a futures contract did not move relative to the price of metal.

If the banks were dumping paper contracts, then the price of these contracts would move down relative to spot. As the chart included shows, that is not how the action went down. The conspiracy mongers don’t want anyone to see this chart.

Markets are complex. There are not only a large number of participants, but also a large variety of participants. It’s not stackers vs. bankers. That’s what makes it so fascinating to study them, and to trade when you can find a good setup.