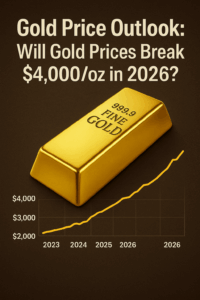

Will Gold Prices Break $4,000/oz in 2026?

The comments below are an edited and abridged synopsis of an article by J.P. Morgan

J.P. Morgan’s latest analysis, written on June 10, presents a compelling gold price outlook driven by a powerful mix of macroeconomic and market forces. Amid growing geopolitical tensions, trade uncertainties, and monetary shifts, gold has enjoyed a robust rally—gaining nearly 30% year-to-date and reaching a high near US$3,500 per ounce in April.

Supporting Factors

Several key dynamics underlie this strong gold price outlook:

- US Dollar Dynamics: The dollar’s current strength seems overextended—approximately 10–15% above its fair value based on swap-rate models. This overvaluation may unwind over time, potentially further supporting gold relative to other assets.

- Demand Patterns: Demand for gold remains broad-based, driven by jewellery (accounting for about 50% of annual consumption), industrial applications like electronics and healthcare (around 10%), and especially investment and reserve management.

- Central Bank Accumulation: Central banks have significantly boosted holdings in recent years. Global net purchases exceeded 1,000 tonnes annually, and over 80% of central banks surveyed intend to increase gold reserves into 2025

Price Forecast

Given these drivers, J.P. Morgan projects a bullish gold price outlook: average prices reaching US$3,675 per ounce by late 2025, and potentially exceeding US$4,000 per ounce by Q2 2026. This reflects sustained central bank demand, elevated investor interest, and continued macroeconomic uncertainty.

Risks & Considerations

Despite the strength in gold, J.P. Morgan highlights two key risks. First, a sustained decline in central bank demand could pressure prices. Second, if US economic growth remains robust—prompting the Fed to raise rates—tightened monetary policy could dampen the gold rally.

Portfolio Implications

For investors, the gold price outlook points to a strategic role for gold: as a diversifier, a hedge against inflation and systemic instability, and a source of portfolio resilience during economic turbulence. Its low correlation with equities and bonds enhances this value proposition.

Conclusion

In summary, J.P. Morgan’s gold price outlook remains firmly bullish. Macro risks, elevated demand from central banks, and a potential correction in dollar strength create an environment conducive to further gains. While risks persist—especially around policy shifts and growth surprises—gold’s enduring appeal as a safe-haven asset underscores its important place in a well-diversified investment strategy.

Also, BMG President & CEO, Yvonne Blaszczyk suggests the asset’s growth is nowhere near hitting its ceiling, predicting gold will rise to a staggering $4,000 USD per ounce by the end of the year, citing global financial and political turmoil as the main drivers behind what she sees as a continuing surge. Read more