Gold: A Safe Haven During Market Instability (And Then There’s China)

The comments below are an edited and abridged synopsis of an article by Richard Mills

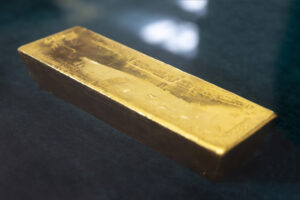

Gold is a safe haven in times of war, or any other type of geopolitical instability.

During the 1970s, when there were a number of upheavals in the Middle East (the Iranian Revolution, the Iran-Iraq War, the Soviet invasion of Afghanistan), gold rose 23% in 1977, 37% in 1978, and 126% in 1979, the year of the Iranian hostage crisis.

Gold also spiked when the US bombed Libya in 1986, when Iraq invaded Kuwait in 1990, after 9/11, and when the US attacked Iraq in 2003.

More recently, in 2020 gold reached $2,034 on fears of Covid causing economic devastation.

While gold has since pulled back due to rising interest rates and 40-year-high inflation, the precious metal returned to safe-haven status following Russia’s invasion of Ukraine.

After the US and the UK announced bans on Russian oil imports, gold touched $2,051, the highest since August 2020 when it reached its all-time peak of $2,072.50.

Up for discussion: Blowing up the Treasury; the emerging market crisis; de-dollarization; safe-haven demand is ramping up; and conclusion.

“The time to buy gold, or any other investment, is when it’s hated and undervalued. The current sentiment in the gold and silver markets is very negative. Producers and junior miners are on sale and the juniors with the best development projects are offering major upside.”