Dealers Putting Clients’ Retirements in Jeopardy | Nick Barisheff

Over time, most investment dealers have implemented misguided policies that will negatively affect their clients’ investment portfolios and their ability to achieve a secure retirement.

There are two main policies that have negative impacts on investors’ portfolios. One is restricting investments to a client’s original Risk Tolerance in the Know Your Client application form (KYC). When opening an account, the client will advise the dealer of their Risk Tolerance. Most clients will indicate that they are medium risk. On March 8, 2017, the OSC implemented risk rating rules that require all mutual funds to rate their fund according to 10-year standard deviation. In 2018, I published an article entitled New Mandatory Risk Rating is Misleading Canadian investors.

Prior to the OSC’s implementation of the risk rating rules, on December 13, 2013, the OSC issued CSA Notice 81-324 and Request to Comment – Proposed CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts. My comments on this policy were submitted to the Ontario Securities Commission on March 12, 2014, along with comments from 50 other industry experts.

I presented a paper to the OSC that argued that Standard Deviation is not an appropriate measure of risk, since the best-performing mutual fund and the worst-performing mutual fund in Canada had the same Standard Deviation. The measure of Standard Deviation of an investment does not reduce the risk of incurring losses.

A better, more accurate methodology would have used downside standard deviation or the Sharpe or Sortino ratios which measure risk adjusted returns. Nevertheless, the OSC implemented risk rating rules requiring all mutual funds to rate the risk of their funds according to 10 year standard deviation.

As a result, if investments in a client’s portfolio exceeded the risk tolerance as indicated in the original KYC, the client was forced to redeem those investments, by the advisor’s compliance department. A number of BMG’s clients were forced to redeem their positions since our funds had a medium-high risk rating according to the OSC formula, and the clients’ KYC indicated medium-risk tolerance. A number of clients wanted to change the KYC in order to allow them to maintain ownership of our funds but were advised that, unless there was a significant change in their financial circumstances, they could not change their KYC.

The second policy that dealers have implemented is Concentration Risk. Clients are not allowed to hold more than 25% in any one investment. If the investment rises and exceeds 25% units are redeemed to reduce their holdings back to 25%. If clients want to add more than 25% the client would need to provide a written trade authorization that would have to be approved by the compliance department. Many investors have investments outside of their brokerage accounts such as real estate and GICs. In that case concentration limits are set to 10% of Investable assets.

As a result, a significant number of clients have terminated their advisors and opened discount brokerage accounts. We refer to these clients as the Do It Yourself (DIY) investors. Not only to the DIY investors save money due to lower management fees, they are able to make their own investment decisions without interference, foregoing financial advice. We have a dedicated web page – BMG DIY Investor – designed specifically for these independent investors.

Today, many investors are concerned about the economic challenges facing them. They realize that the equity markets are the most overvalued and longest-running in history and are vulnerable to a major correction.

As a result they are exposed to losses of 50% to 70% in their equity investments according to a number of analysts. Apart from equities, the fixed income part of their portfolios will also experience significant losses if central banks raise interest rates to fight inflation.

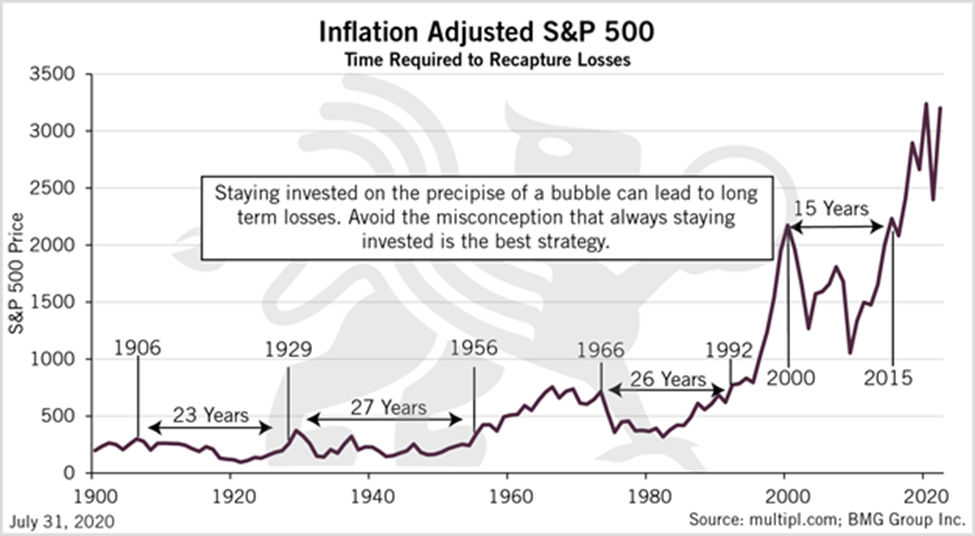

While holding a mix of 60/40 of stocks and bonds may have generated good results during the past 10 years, it is unlikely to be repeated during the next 10 years. Moreover, if markets experience a major correction it will take a long time just to break even.

The 1929 Crash took 27 years to break even and the Dot Com Crash took 15 years to break even. Retired baby boomers may not live long enough to break even after this crash.

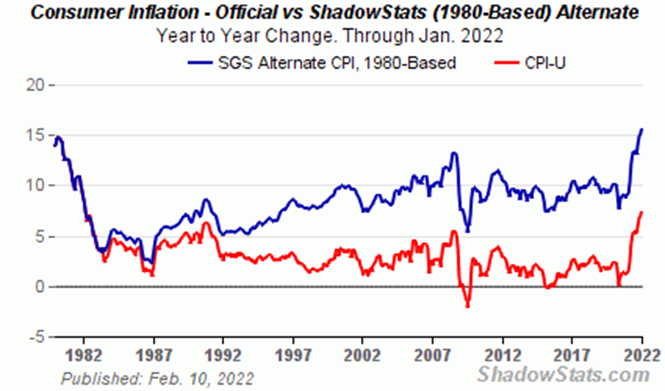

Investors are also concerned about the loss of purchasing power of their investments. Official inflation is now 7.9%; that translates to 15% using Shadowstats methodology.

The reality is that, unless the portfolio is generating returns in excess of the inflation rate, the investor is losing purchasing power.

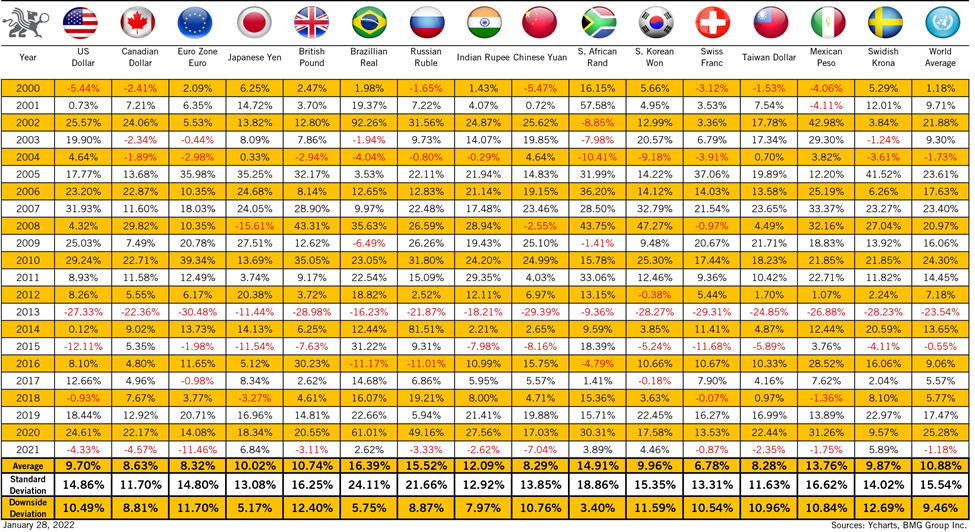

Precious metals have performed well, rising 6.7% this year to the 1st of March. Over the past twenty years gold has averaged over 11% per year in all currencies, as can be seen in this chart.

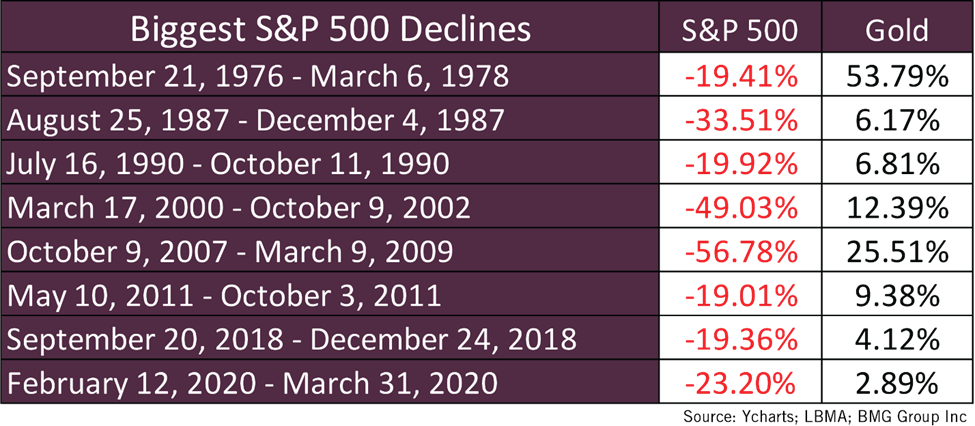

In addition, gold has performed exceptionally well during market declines.

Compliance departments hold the mistaken notion that precious metals funds are a risky asset, and therefore limit client holdings to 25%. They do not differentiate between mining stock funds and bullion funds. These two categories of precious metals mutual funds have completely different risk profiles. Their view on the risks of gold bullion contradicts the major regulatory authorities such as the Bank of International Settlements (BIS), which regulates global central banks. The BIS considers gold a zero risk monetary asset.

In addition, compliance departments base their risk decision based on standard deviation rather than considering the current economic and geopolitical risks. This is a mistaken notion, as gold has a lower standard deviation and a higher return than most of the DOW components.

While I wrote my book $10,000 Gold – Why Gold’s Inevitable Rise is the Investors Safe Haven in 2013, today I firmly believe that gold will achieve this level and that investors will not only face devastating losses in their investment portfolio, but also miss out on a once-in-a-lifetime investing opportunity.