Central Banks May Ramp up Gold Buying

The comments below are an edited and abridged synopsis of an article by Stefan Gleason

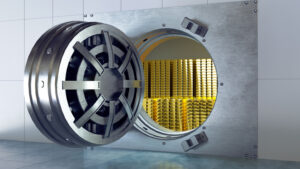

Ignore what central bankers are saying; instead, watch what they are doing. While they dismiss gold or pretend it doesn’t exist, global central banks have been accumulating gold bullion for several years now.

Central bank gold buying over the last decade helped support the gold price, although the sharp trend higher in central bank purchases did pause last year as record prices and the global pandemic took hold.

Central bank acquisitions got off to a slow start in 2021. But as the buying trend resumes, they will likely become net buyers for the year.

There are several reasons why these powerful financial institutions are adding gold to their reserves. These include diversification, stability and potential price appreciation, all discussed here.

The gold market has come a long way recently, and may just be getting started on a multiyear bull run higher. The yellow metal has, since the early 2000s, more than quadrupled in value as measured in US dollars.

Gold made all-time highs last summer at nearly $2,100, and still trades near that in virtually all world currencies. Given the free-wheeling printing press policies of every central bank, there is no barrier to a sharply higher gold price.

If the US dollar continues to weaken, pushing inflation higher, gold could easily double or more from recent levels, putting $5,000 per ounce on the table.

There are many reasons for owning physical gold. The three outlined here (diversification, stability, price appreciation) are some of the biggest, and are primary drivers of central bank buying.

If the biggest, most powerful financial institutions in the world see the value opportunity presented by gold ownership, shouldn’t you?