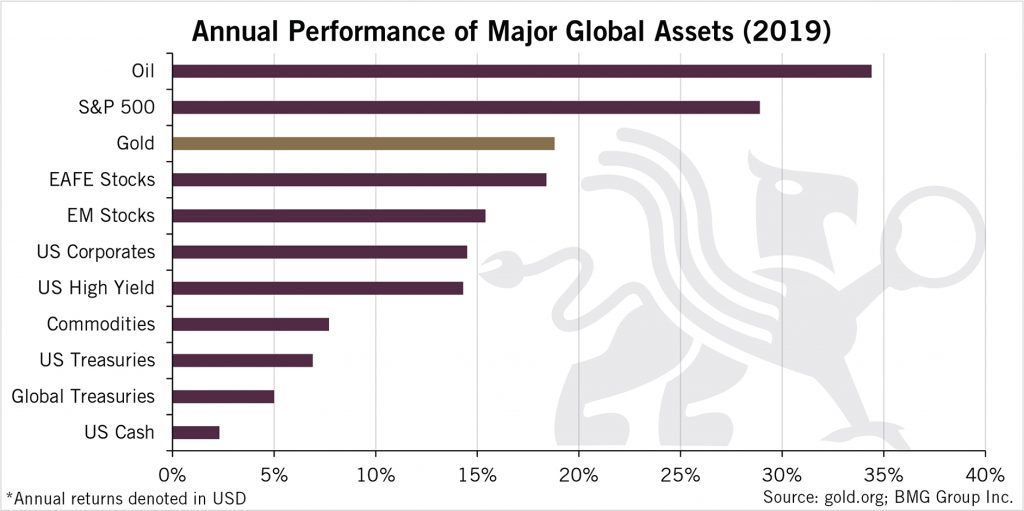

Annual Performance of Major Global Assets | BullionBuzz Chart of the Week

This week’s Chart of the Week shows the Annual Performance of Major Global Assets including Oil in USD.

Source: gold.org; BMG Group Inc.

What is an Asset Class?

An asset class is a grouping of investments that exhibit similar characteristics and are subject to the same laws and regulations. Asset classes are made up of instruments which often behave similarly to one another in the marketplace. Historically, the three main asset classes have been equities (stocks), fixed income (bonds) and cash equivalent or money market instruments. Currently, most investment professionals include real estate, commodities, futures, other financial derivatives and even cryptocurrencies to the asset class mix. Investment assets include both tangible and intangible instruments which investors buy and sell for the purposes of generating additional income on either a short- or a long-term basis.

Understanding Asset Class

Simply put, an asset class is a grouping of comparable financial securities. For example, IBM, MSFT, AAPL are a grouping of stocks. Asset classes and asset class categories are often mixed together. There is usually very little correlation, and in some cases a negative correlation, between different asset classes. This characteristic is integral to the field of investing.

Financial advisors view investment vehicles as asset class categories that are used for diversification purposes. Each asset class is expected to reflect different risk and return investment characteristics and perform differently in any given market environment. Investors interested in maximizing return often do so by reducing portfolio risk through asset class diversification.

Financial advisors focus on asset class as a way to help investors diversify their portfolio. Different asset classes have different cash flows streams and varying degrees of risk. Investing in several different asset classes ensures a certain amount of diversity in investment selections. Diversification reduces risk and increases your probability of making a return.

Source: gold.org; BMG Group Inc.