Buying Opportunity before Fed Pivot: Silver Price Is Going to $500, US Dollar Will Crash—Robert Kiyosaki

The comments below are an edited and abridged synopsis of an article by Anna Golubova

In message to his Twitter followers, author Robert Kiyosaki said it’s time to use the Fed’s aggressive stance to buy more gold, silver and Bitcoin.

As the Fed prepares to raise interest rates by another 75 basis points for the fourth time in a row at its November meeting, Kiyosaki says it is time to do some precious metals shopping.

“Buying opportunity: If Fed continues raising interest rates US$ will get stronger, causing gold, silver & Bitcoin prices to go lower. Buy more. When Fed pivots and drops interest rates as England just did, you will smile while others cry. Take care,” he tweeted recently.

Dollar strength, which has been keeping downward pressure on gold and silver, will not last, Kiyosaki said. All of Q3, the US dollar index has traded near 20-year highs.

Kiyosaki believes the dollar will crash by January 2023 after the Fed pivots.

Kiyosaki said he is buying more silver. “To profit from crash of US$ I bought many more US silver Buffalo rounds. Silver is a bargain. I will not be a victim of the f****** Fed,” he said.

Kiyosaki anticipates silver jumping to $100 and then to $500 within this decade.

“Why I suggest ‘buy silver.’ For $25, everyone can buy a silver coin. Don’t take my word for it. Study. Become rich. Don’t be a fool,” he said in another post.

December silver futures have surged to 6-week highs, last trading at $20.55, up nearly 8% on the day. In the meantime, December gold futures breached the key $1,700 level, last trading at $1,700.70, up 1.72% on the day.

Kiyosaki explained that investors need to protect their portfolios with hard assets like gold and silver as the biggest crash in history unfolds.

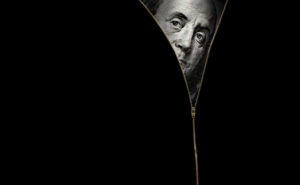

“Anything that can be printed, like a stock certificate, a bond, or a dollar, I don’t want it,” he noted. “I’m a hardcore gold, silver, oil, and food buff… I’m a hardcore hard assets person.”