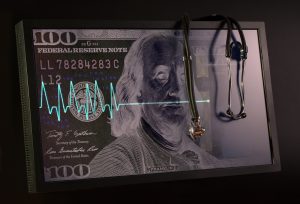

Why A Dollar Collapse Is Inevitable

The comments above & below is an edited and abridged synopsis of an article by Alasdair Macleod

We have been here before—twice. The first time was in the late 1920s, which led to the dollar’s devaluation in 1934. And the second time was 1966/1968, which led to the collapse of the Bretton Woods System. Even though gold is now officially excluded from the monetary system, it does not save the dollar from a third collapse, and it will still be the yardstick.

This article explains why another collapse is due for the dollar. It describes the errors that led to the two previous episodes, and the lessons from them relevant to understanding the position today. And just because gold is no longer officially money, it will not stop the collapse of the dollar, measured in gold, again.

This article explains why another collapse is due for the dollar. It describes the errors that led to the two previous episodes, and the lessons from them relevant to understanding the position today. And just because gold is no longer officially money, it will not stop the collapse of the dollar, measured in gold, again.

It is now 47 years since all forms of monetary gold were banished. Historians educated as Keynesians and monetarists do not understand the economic history of money, let alone the difference between a gold standard and a gold exchange standard. These monetary systems must be defined, and the differences between them noted, for anyone to have a chance of understanding this vital subject, and its relevance to the situation today.

Up for discussion: Defining the role of gold; the gold exchange standard in the 1920s; the gold exchange standard of Bretton Woods; and the situation today.