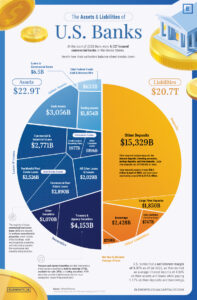

Visualizing The Assets And Liabilities of US Banks

The comments below are an edited and abridged synopsis of an article by Niccolo Conte

The US has more than 4,000 FDIC-insured banks that play a crucial role in the country’s economy by securely storing deposits and providing credit in the form of loans.

An infographic provides a visualization of all the deposits, loans and other assets and liabilities that make up the collective balance sheet of US banks using data from the Federal Reserve.

With the spotlight on the banking sector after the collapses of Signature Bank, Silicon Valley Bank and First Republic bank, understanding the assets and liabilities that make up banks’ balance sheets can give insight in how they operate and why they sometimes fail.

Up for discussion: Assets—The building blocks of banks’ business; loans and leases; securities; cash assets; liabilities—banks’ financial obligations; deposits; borrowings; and how deposits, rates and balance sheets affect bank failures.