Visualizing Gold Performance and US Debt | Chart of the Week

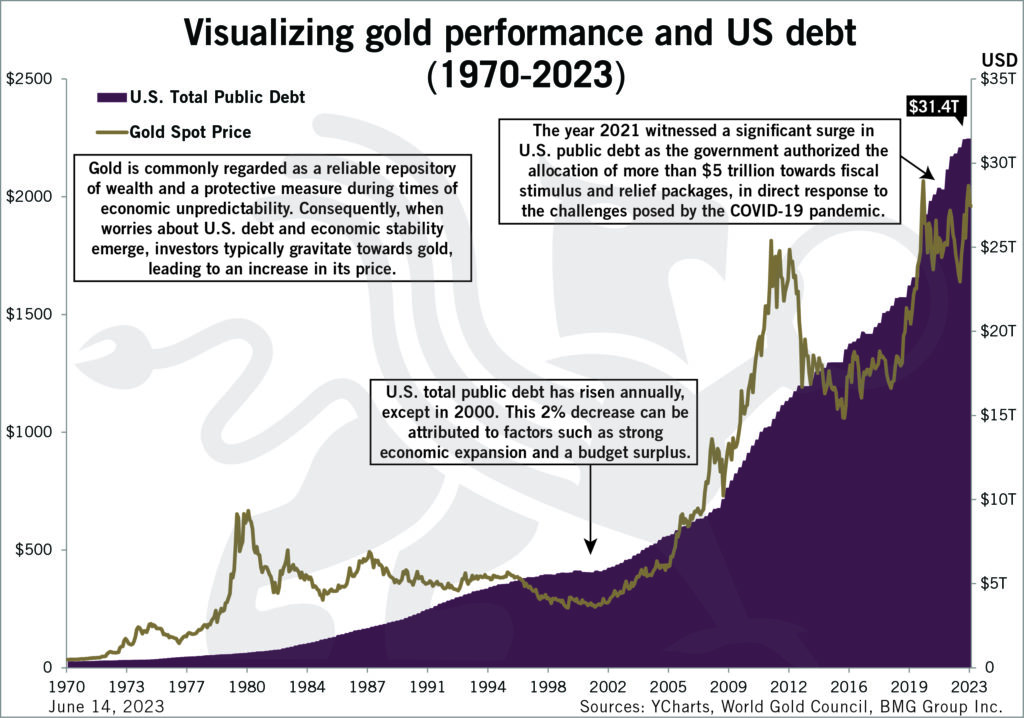

Gold is commonly regarded as a reliable repository of wealth and a protective measure during times of economic unpredictability. Consequently, when worries about US debt and economic stability emerge, investors typically gravitate towards gold, leading to an increase in its price.

The year 2021, witnessed a significant surge in US public debt as the government authorized the allocation of more than $5 trillion towards fiscal stimulus and relief packages, in direct response to the challenges posed by the COVID-19 pandemic.

US total debt has risen annually, except in 2000. This 2% decrease can be attributed to factors such as strong economic expansion and a budget surplus.

Sources: YCharts, World Gold Council, BMG Group Inc.