US Dollar Index’s Relationship with Gold | Chart of the Week

Sources: Ycharts; LBMA; finance.yahoo; BMG Group Inc.

The U.S. Dollar Index (USDX), also known as the DXY index, is a measure of the value of the United States dollar relative to a basket of foreign currencies. It provides a weighted average of the dollar’s exchange rates against a group of major currencies, including the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc.

Gold, on the other hand, is a precious metal that has been widely recognized as a store of value throughout history. It is often considered a hedge against inflation and a safe haven asset during times of economic uncertainty.

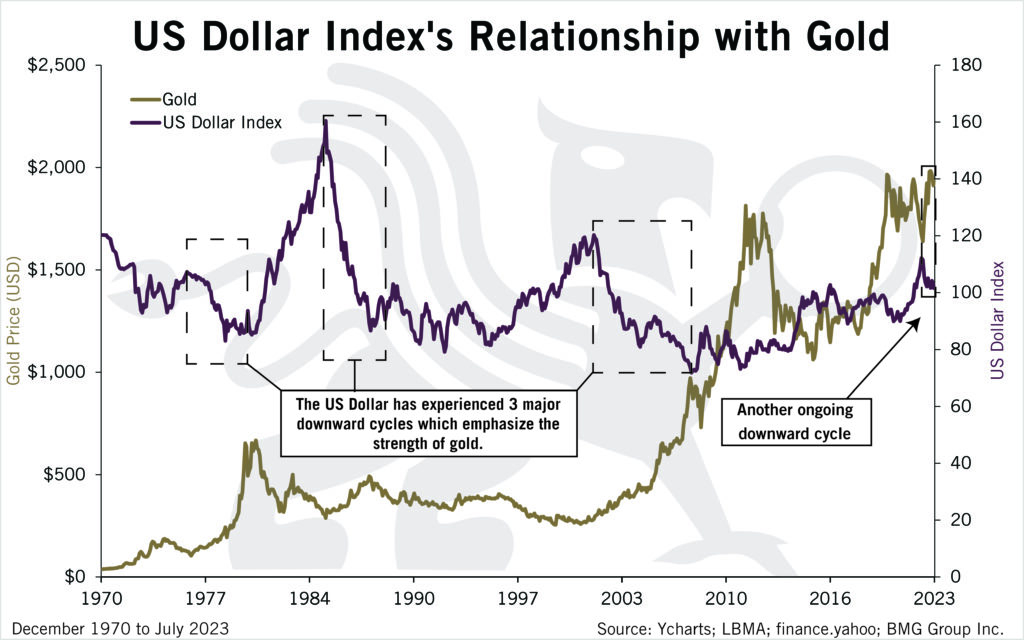

The relationship between the U.S. Dollar Index and gold is often seen as inverse or negatively correlated. When the value of the U.S. dollar strengthens against other major currencies, the USDX tends to rise. In such cases, the price of gold, which is typically denominated in U.S. dollars, may decrease as it becomes relatively more expensive for holders of other currencies.

Conversely, when the U.S. dollar weakens and the USDX declines, the price of gold may rise. This is because a weaker dollar makes gold relatively cheaper for holders of other currencies, leading to increased demand for gold as an alternative store of value.

It’s important to note that the relationship between the U.S. Dollar Index and gold is not always perfectly inverse and can be influenced by other factors such as global economic conditions, interest rates, geopolitical events, and market sentiment. Additionally, other factors specific to the gold market, such as supply and demand dynamics, investor sentiment, and industrial uses, can also impact the price of gold.