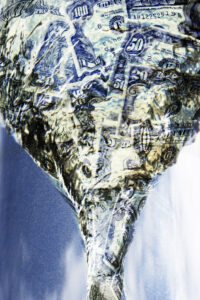

CPI Review: The Inflationary Storm Has Finally Hit!

The comments below are an edited and abridged synopsis of an article by Phoenix Capital Research

The official inflation measure for the US, the Consumer Price Index (CPI), skyrocketed to 4.2% year over year. Core CPI, which is the most essential component, recorded a year-over-year jump of 3%.

That doesn’t sound like much, but consider that the CPI exists so that the government can downplay inflation. There are endless gimmicks used to massage this number as low as possible.

For instance, the CPI: doesn’t include food or energy inflation, despite the fact that those are two of the most necessary goods for consumers to survive; weighs the cost of goods and services geometrically instead of by their actual price; uses substitution or replaces items that it measures if they become too expensive.

The bottom line: The CPI is designed to hide inflation and, despite all of the gimmicks and games played by the government, the official inflation number still clocked in at 3%. This is the highest core CPI since 1982, when interest rates were at 19% as the Fed desperately tried to control inflation.

This time, the Fed has rates at zero while printing $125 billion in new money per month.

To make things worse, the Fed is in denial that inflation even exists. Various Fed officials have argued that the spike in inflation is transitory, i.e. the Fed doesn’t need to do anything about it.

The White House is also in denial about this problem, claiming that if base effects were removed, CPI would only be 2.1%. Bear in mind that the CPI has dozens of ways to hide real inflation levels.

So, the Fed and the White House are in complete denial about this problem, which means that inflation is going to rage.