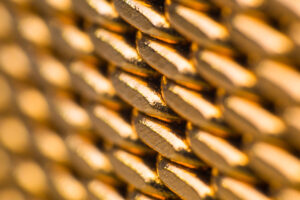

Gold Price Forecast: New All-Time Highs Coming

The comments below are an edited and abridged synopsis of an article by Christopher Aaron

Gold is on the verge of new all-time highs. It has already broken out to new all-time highs in many world currencies, and the last—yet most important—will be gold priced in US dollars.

On the heels of the 0.25% interest rate hike by the Federal Reserve, and amid clear signals that it is ready to print new money to support the financial system after the failures of Silicon Valley Bank and Signature Bank, gold rose $30 or 1.5% to close at $1,970 per ounce in the spot market last week.

Aaron discusses gold priced in several world currencies—Japanese yen, Australian dollars, British pounds, New Zealand dollars, and euros—to glimpse what is in store for the yellow metal in US dollars over the months ahead.

The takeaway: The Fed is losing credibility in its fight against 40-year-high inflation as it begins to print new money once again to bail out the banking system.

Gold is responding by breaking out to new highs in several major world currencies. Further, it is on the verge of doing so in several others, including the US dollar.

Investors should be using any final pullback in the gold price over the coming months to finalize their precious metals positions, because once gold breaks out, it may not look back.

While bullion should be expected to rise by 20%—25% following gold’s breakout, mining companies, which are leveraged to the underlying metal price, have the potential to rise 100% or more during the same time period.