The Hannibal Trap Will Crush Global Wealth

The comments below are an edited and abridged synopsis of an article by Egon von Greyerz

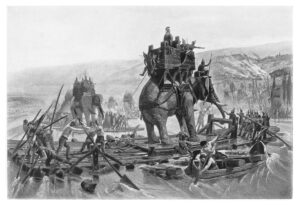

Is the global investment world about to be caught in the Hannibal trap? Hannibal was one of the greatest military tacticians and generals in history. He was a master of strategy and regularly doled out painful defeats to his enemies.

Up for discussion: the battle at Lake Trasimene; Covid attacked an already weakened world; billionaires’ wealth is up 70% in three years; global debt fuels global wealth; the biggest wealth trap in history; robber barons; fantasy valuations; stocks are driven by liquidity, not value investing; the Hannibal trap; the Dow will lose 97% in real terms—gold; history proves that only gold preserves wealth in real terms; the biggest wealth destruction; and history, history, history.

Vast fortunes will be wiped out in coming years, and other fortunes will be made in areas like hard assets and the resource industry. Precious metals will be a major beneficiary.

Some of the shrewd Swiss private banks like Lombard Odier advised their clients to hedge their portfolios with gold earlier this year. Very few wealth managers are as clever as 200-year-old Swiss banks.

Precious metals mining stocks are likely to do spectacularly well in the coming currency collapse, and so will gold and silver. But the ultimate wealth preservation in the next 10 years is physical gold and silver held outside the banking system.

Remember: Markets can always go higher, even though they are massively overvalued. But when risk is at a maximum, investment is not about squeezing the last bit of profit out of your portfolio. Instead, it is about protecting your profits. And you can’t do that by staying fully invested in overvalued assets.

In a secular bear market, everyone is a loser. The trick is to lose as little as possible.