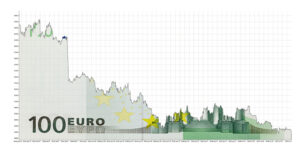

A Euro Catastrophe Could Collapse It

The comments below are an edited and abridged synopsis of an article by Alasdair Macleod

Macleod reviews the euro system in the context of rising interest rates. Central to the problem is role of the ECB, which through monetary inflation embarked on a policy of transferring wealth from fiscally responsible member states to the spendthrift PIGS and France. The consequences of these policies are that the spendthrifts are now ensnared in irreversible debt traps.

Even in a Keynesian context, the ECB’s monetary policy is no longer to stimulate the economy, but to keep the spendthrifts afloat. The situation has deteriorated so that eurozone commercial banks appear to have credit restricted in New York, evidenced by the reluctance of the US banks to enter into repo transactions with them, leading to the market failure in September 2019 when the Fed had to intervene.

An examination of the numbers strongly suggests that even eurozone banks, insurance companies and pension funds are no longer net buyers of eurozone government debt. It could be because the terms are unattractive. But if so, it is an indictment of the ECB’s asset purchase programs deliberately suppressing rates to the point where they are unattractive, even to normally compliant investors.

Consequently, without any savings offsets, the ECB has gone full Rudolf Havenstein, and is following similar inflationary policies to those that impoverished Germany’s middle classes and starved its labourers and the elderly in 1920-1923. That the German people are tolerating such an obvious destruction of their currency for the third time in a hundred years is astounding.

Up for discussion: Institutionalized Madoff; the eurozone’s banking instability; the euro credit cycle has been suspended; the commercial banks’ position; government finances are out of control; and conclusion.