Charts for A Crazy World: Stats That Contradict The Official Line

The comments below are an edited and abridged synopsis of an article by John Rubino

A lot of headline numbers show a US economy that’s in pretty good shape. Official unemployment is 5%. GDP is growing at an acceptable 3% rate. Stocks are at all-time highs. Bonds, from US Treasuries to corporate junk, are priced as richly as they’ve ever been. These are all signs of robust health.

That is, until you remember that the cost of achieving this kind of statistical nirvana keeps rising. Just a couple of many possible examples: With messed up supply chains producing a shortage of new cars, used car prices are soaring, which forces buyers to finance amounts that can’t help but strain family budgets.

Students, meanwhile, are still borrowing crazy amounts of money for questionable degrees, but in an era of campus lockdowns and distance learning, the education they’re borrowing to buy is even more questionable than before.

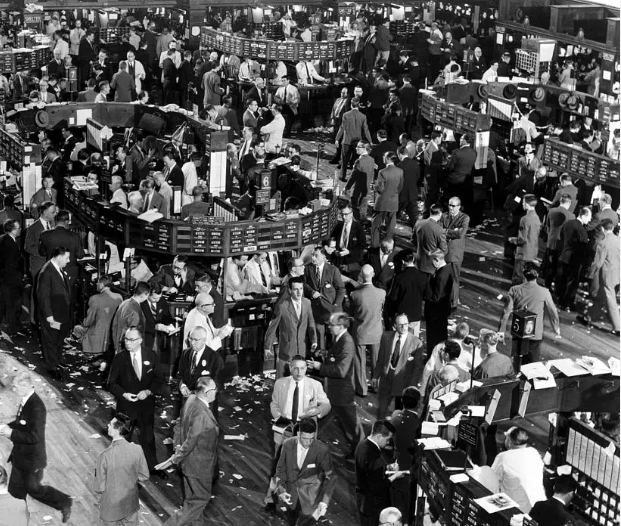

As for stock prices and market action, an evocative chart from Northman Trader illustrates the kind of setup that, in pre-QE days, would have had short-sellers salivating. Now it’s a setup for governments buying equities to keep the rally going.

Another part of life where the headlines seem out of step with reality is the current pandemic debate. The US, along with much of the rest of the world (see Australia’s descent into quasi fascism) is apparently drifting back into a crazy quilt of mask mandates and vaccine passports that will make it hard for most small businesses to survive.

The pandemic’s actual damage doesn’t seem to match the draconian response. Rubino discusses the CDC’s ‘Covid death tracker;’ flu and pneumonia claiming more casualties than Covid; mask mandates; and Sweden’s response to the pandemic.