Buying The Dip Is Suddenly A More Risky Business

The comments below are an edited and abridged synopsis of an article by Michael Msika and Jan-Patrick Barnert

Many investors finally have what they wished for: A chance to buy the dip. The problem is that uncertainty is much higher now.

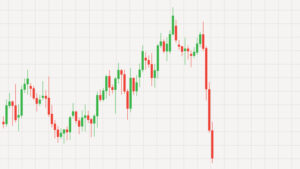

Last Friday’s selloff brought a halt to the market’s exuberance. The Stoxx 600 Index is now more than 5% below its record high of mid-November, opening a window for those who have been awaiting weakness to add positions.

But is now the right time to buy? Prior to last week, markets had become complacent about a resurgence of Covid-19. With a new variant having emerged, much will depend on how it affects society. A return to restrictions and lockdowns would be a cause for concern.

There is uncertainty over how effective vaccines will be on the new strain. As a result, traders are selling off in energy, mining, financials and consumer discretionary against healthcare, utilities and technology stocks.

The effect is disarray among reopening plays. A Barclays basket of vaccine beneficiaries has erased all gains for the year, while a Bloomberg gauge of airlines has dropped 21% in dollar terms and is close to erasing all gains since Pfizer and BioNTech announced their vaccine breakthrough a year ago.

With the potential impact on economies, value stocks are now back to flat since March.

High levels of volatility and derivatives trading also points to a loss of confidence among equity bulls. The VStoxx Index gained 51% on Friday, the biggest intraday jump since February 2020. And twice as many Euro Stoxx 50 put options were traded versus normal.

An increased need for downside protection may lead to exaggerated market moves ahead. For the S&P 500, market makers who sold puts may need to sell more futures to hedge themselves should the market fall further. They may also have to cover themselves the other way should stocks bounce back.

“We believe equity volatility will be the best asset class in 2022,” says Jefferies strategist Sean Darby. He expects a further unwinding of flows from risky assets into safe assets after risk appetite reached seemingly insatiable levels.