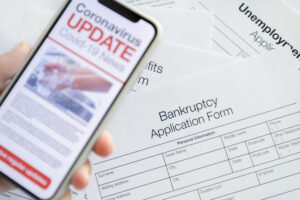

The Wave of Covid Bankruptcies Has Begun

The comments below are an edited and abridged synopsis of an article by Jonathan O’Connell, Anu Narayanswamy

A year since Covid-related shutdowns began, more businesses are filing for bankruptcy. Chapter 11 filings were up nearly 20% in 2020 compared with the previous year.

Some sectors are faring worse than others, with restaurants, retailers, entertainment companies, real estate firms and oil and gas ventures filing for protection in far greater numbers than in previous years.

Bankruptcies filed by entertainment companies in 2020 nearly quadrupled, and filings nearly tripled for oil and gas companies, doubled for computer and software companies and were up 50% or more for restaurant owners, real estate companies and retailers, compared with 2019. There were 5,236 Chapter 11 filings in 2019, but 6,917 last year, a tally at least 30% higher than any of the previous four years.

Despite $3.7 trillion in stimulus spending, and another $1.9 trillion being proposed, businesses in certain industries are particularly vulnerable and may take years to recover. Others will not recover at all.

The steep jump in bankruptcies among a few industries could be the beginning of a wave of filings by companies who can no longer pay their debts.

Because bankruptcy filings lag other signals of economic distress, the worst may be yet to come. Bankruptcies stemming from the 2007 financial crisis didn’t peak until 2010.

Other types of bankruptcy filings, those for individuals and those from businesses planning to liquidate were both down by about 30% in 2020 compared with 2019 levels despite the economic pain wrought by Covid-19. Early data for 2021 shows slightly fewer large bankruptcies have taken place so far compared with last year.

Those decreases could be signs that federal and local stimulus efforts have at least delayed many individuals and businesses from hitting bottom.

Hundreds of bankruptcies that have already taken place are clearly a by-product of the pandemic and its year-long squeeze on the economy. Many of them will not recover.