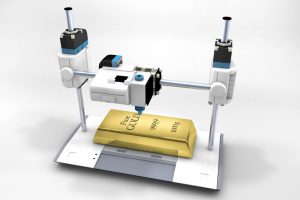

You Can’t Just Print More Gold

The comments below are an edited and abridged synopsis of an article by Frank Holmes

Thanks to the economic impact of Covid-19, additional fiscal stimulus is likely needed in the US.

The House has already passed a $3 trillion relief package. Senate Majority Leader Mitch McConnell has made it clear that the next coronavirus bill cannot exceed $1 trillion. Even so, the US government’s response is already massive, dwarfing anything that’s come before it.

Britain’s government is spending in a similar manner. The UK budget deficit widened to a record 62.1 billion pounds ($76 billion) in April, equal to the government’s total borrowing in 2019.

Against this backdrop of anything-goes spending, the idea of having a national currency backed by a real asset like gold seems less crazy. It would force lawmakers to practice fiscal discipline, rein in inflation and normalize international trade.

Judy Shelton (of the Fed Board of Governors) has long favoured a return to a gold standard, which officially ended in 1971. In a recent interview, Shelton said she liked the idea of a gold-backed currency.

Although the chances of the US returning to a gold standard are slim, it’s important in this time of economic uncertainty to ensure you have a 10% weighting in gold and gold mining stocks (Holmes’s 10% Golden Rule).

The 10% Golden Rule is rational and prudent. The US government and the Fed can’t pump this much money into the financial system and not trigger rapid inflation—and potentially even hyperinflation.

Gold can’t be printed. In fact, we may be looking at peak gold supply right now, which should only help the precious metal retain its value as cash deteriorates.

Up for discussion: Unprecedented money printing; UK bonds now have a negative yield, iss the US next; and big-name money managers back gold.