Three Decades of Central Bank Gold Demand | Transition from Net Sales to Net Acquisitions | Chart of the Week

Sources: Visualcapitalist, Metals Focus, Refinitiv GFMS, World Gold Council, BMG Group Inc.

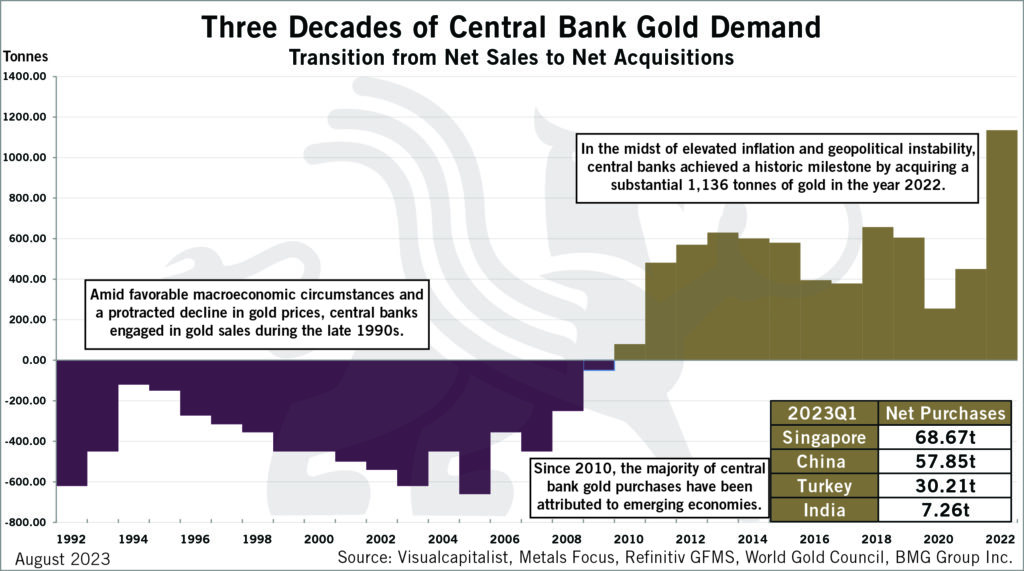

Amid favorable macroeconomic circumstances and a protracted decline in gold prices, central banks engaged in gold sales during the late 1990s.

In the midst of elevated inflation and geopolitical instability, central banks achieved a historic mileston by acquiring a substanital 1, 1236 tonnes of gold in the year 2022.

Since 2010, the majority of central bank gold purchases have been attributed to emerging economies.