Loss of Purchasing Power by Decade (USD) | Chart of the Week

Sources: Ycharts; Statistics Canada; BMG Group Inc.

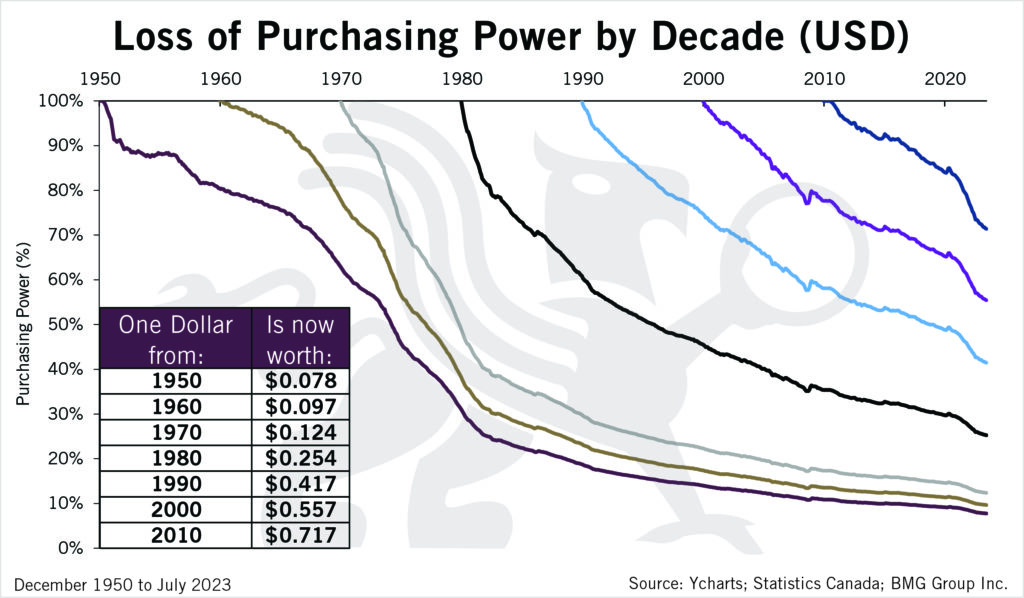

Purchasing power refers to how much you can buy with your money. As prices rise, your money can buy less. As prices drop, your money can buy more.

Inflation is the gradual rise in the prices of a broad range of products and services. If inflation persists at a high level or gets out-of-control, it can eat away your purchasing power—what you can buy with the money you have. The same product that cost $2 six months ago might now cost $4, due to inflation. This rise in prices in turn can erode people’s savings and consequently, their standard of living.

Long-time investors know that loss of purchasing power can greatly impact their investments. Rising inflation affects purchasing power by decreasing the number of goods or services you can purchase with your money.

Investors must look for ways to make a return higher than the current rate of inflation. More advanced investors may track international economies for the potential effect on their long-term investments.

Source: Investopedia