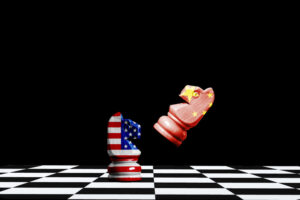

Yuan Exceeds Dollar in China’s Bilateral Trade for First Time

The comments below are an edited and abridged synopsis of an article by Noriyuki Doi and Saki Akita

The yuan was used in 49% of China’s cross-border transactions last quarter, topping the US dollar for the first time, mainly due to a more open capital market and more yuan-based trade with Russia.

The dollar’s share is the largest globally at 42%, including trades between countries other than China. The yuan represented 2.77% and ranked fifth overall after the euro, the pound and the yen.

The yuan’s share of global payments is up from 1.81% about five years ago. Bilateral payments, backed by China’s economic influence, have gradually expanded its foothold.

Cross-border settlements in yuan totaled 42.1 trillion ($5.85 trillion) in 2022. Capital transactions accounted for 31.6 trillion yuan, or about 75%, with current-account transactions such as trade making up the rest.

Yuan-denominated international payments last quarter grew 11% on the year to $1.51 trillion, while dollar payments shrank 14% to $1.4 trillion.

China first allowed trade payments to be settled in yuan in 2009. This included settlements for freight, services and current account transfers, as well as capital transaction settlements, including for stocks and bonds.

China’s opening of its capital markets and a push away from the dollar in trade have been key factors in the shift toward the yuan.

China has opened the door for foreign investors to trade in yuan-denominated stocks and bonds via Hong Kong. Similar links for ETFs and interest rate swaps debuted in 2022 and this year, respectively.

Russia has used the yuan more since Western sanctions imposed last year cut it off from dollar and euro payment networks. The yuan made up a record 39% of total volume in Russia’s forex market in March.

China and Brazil have reached a deal enabling direct exchanges between the yuan and the real without using the dollar as an intermediary. Argentina said it will use yuan for paying for imports from China.

Many emerging economies seek to reduce their dependence on the dollar, and Washington’s leveraging of the dollar’s dominance for sanctions against Russia has provided further motivation.

This could spur currency decoupling or the formation of currency blocs, with some continuing to use the dollar while China and countries with close political or economic ties to Beijing move toward the yuan.

China also looks to use its immense buying power to put a dent in the dollar’s grip on commodity markets.

Broader international use of the yuan has been hindered by tight controls on exchanging the currency and moving it in or out of the country, intended to prevent big market swings. Some observers expect restrictions to be eased gradually to strike a balance between stability and usability.