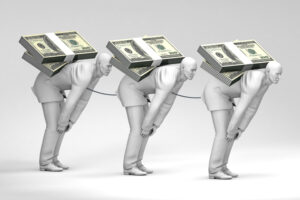

Wage Slaves vs. Gold Owners, Revisited

The comments below are an edited and abridged synopsis of an article by Richard Mills

“It’s not a stretch to envision a scenario whereby the world’s reserve currency, the US dollar, collapses under the weight of unmanageable debt, triggered say, by a mass offloading of US Treasuries by foreign countries, that own about $7.5 trillion of US debt (a selloff may also occur due to investors sick of getting such low yields for their US government bonds).”

“This would cause the dollar to crash, and interest rates would go through the roof, choking consumer and business borrowing. Import prices would skyrocket too, the result of a low dollar, hitting consumers in the pocket-book for everything not made in the US. Business confidence would plummet, mass layoffs would occur, growth would stop, and the US would enter a recession.”

“Owning gold (and silver) continues to be the best defense against inflation, stagflation, and rampant currency debasement, during this period of unprecedented and irresponsible debt accumulation.”

“Also, when government can’t offer a positive real return, gold usually functions as the asset of last resort.”

Mills discusses inflation and loss of purchasing power; loser bonds; real yields and gold; gold and debt to GDP; the role of the Fed; and an instrument of inflation.