John Ing: 4th Bull Market in Gold Has Just Begun

The comments below are an edited and abridged synopsis of an article by King World News

John Ing, connected in China at the highest levels, says that central banks, politicians and policymakers are surprised that November inflation in the US surged to 6.8%, a nearly 40-year high, about triple the Fed’s 2% target. US producer prices rose at the fastest pace on record. Having underestimated inflation, the Fed downplayed its significance and said that the spike was transitory and due to one-off causes, such as supply chain disruptions. It ignored the fact that overspending and too much credit are inflation drivers. Having released the inflation genie, it continues to pursue the identical policy responses as too much money chases too few goods, leading to distortions in the equity and fixed income markets.

Supply chain bottlenecks, labour shortages and OPEC have been blamed for the rising inflation. And now, with out-of-control food, energy and housing prices putting upward pressure on prices, politicians and central bankers say that we need more post-pandemic spending since demand might abate once the bottlenecks are resolved. Yet higher prices have not blunted demand for more government services. Having issued record debt levels at historically low interest rates, they have lost their fear of debt. Worrisome, too, is that since they missed the causes of the inflation surge, how can they come up with a remedy?

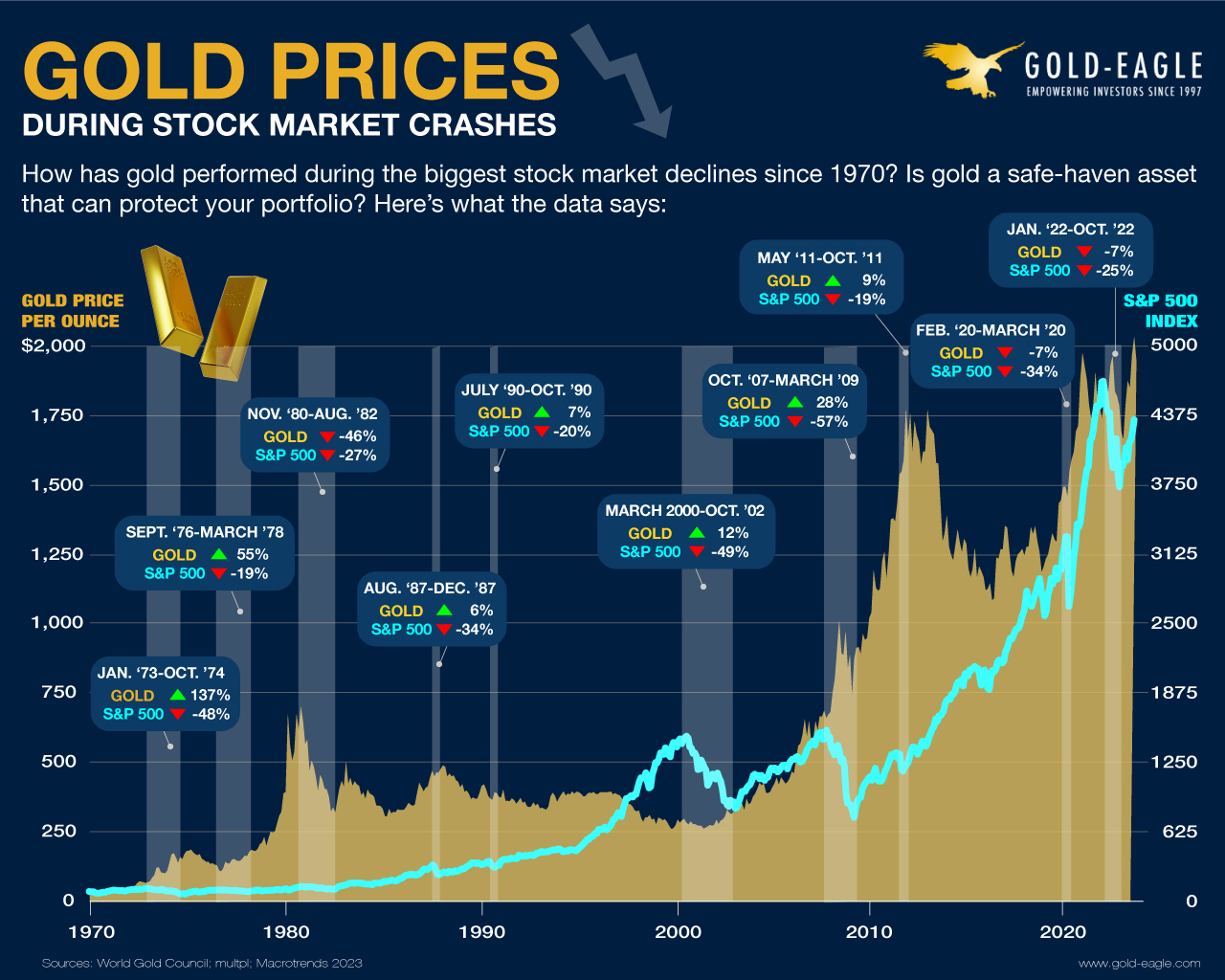

Up for discussion: the fiscal fiasco; the US stock bubble is the biggest in history; That 70s Show; America’s energy price shock; greenflation; money meets climate; don’t shoot the messenger; duelling nations decouple; the demonization of China will have its costs; America’s debt is its Achilles heel; recommendations; the 4th bull market in gold has just begun; and the never normal.