Visualizing 150 Years of US National Debt

The comments below are an edited and abridged synopsis of an article by Tyler Durden

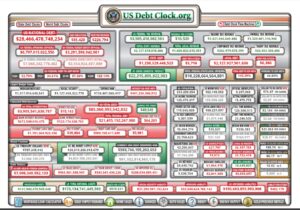

The US national debt reached an all-time high of $28 trillion in March 2021, the largest ever recorded.

Recent increases to the debt have been fueled by massive fiscal stimulus bills like the CARES Act ($2.2 trillion), the Consolidated Appropriations Act ($2.3 trillion), and the American Rescue Plan ($1.9 trillion).

To see how America’s debt has evolved, Durden examines an interactive timeline using data from the Congressional Budget Office (included).

The national debt hasn’t always been this large. Looking back 150 years, its size relative to GDP fluctuated greatly, hitting multiple peaks and troughs. These movements generally correspond with events such as wars and recessions. Durden discusses the Great Depression; World War II; the postwar period; and the 2008 global financial crisis.

The Covid-19 pandemic damaged many areas of the global economy, forcing governments to drastically increase their spending. At the same time, many central banks once again reduced interest rates to zero.

This has resulted in a growing snowball of government debt that shows little sign of shrinking, even though the worst of the pandemic is over.

In the US, federal debt has reached or surpassed WWII levels. When excluding intragovernmental holdings, it now sits at 104% of GDP—and including those holdings, it sits at 128% of GDP. But while the debt is expected to grow even further, the cost of servicing this debt has actually decreased in recent years.

This is because existing government bonds, which were originally issued at higher rates, are now maturing and being refinanced to take advantage of today’s lower borrowing costs.

The key takeaway is that the US national debt will remain manageable in the short term. Longer term, however, interest expenses are expected to grow significantly—especially if interest rates begin to rise again.